Table of Content

Drop off your tax recordsdata at an office and have a tax pro put together your tax return for you. Depending on your tax situation, you could possibly file your taxes at no cost withH&R Block Free Online. Tax Credits and Deductions Learn about tax aid, credit, deductions, and the way they apply to training, charitable donations, and more. The only unfavorable consequence of sending your return to the incorrect address is that your refund and the processing of your type will most probably be delayed by a few weeks. However, if you want to submit your tax return you want to make positive you have the proper handle and that you are posting it well prematurely of the deadline.

All monetary products, buying services are introduced with out guarantee. When evaluating offers, please evaluate the monetary institution’s Terms and Conditions. If you find discrepancies together with your credit score rating or info from your credit score report, please contact TransUnion® immediately. Ensuring their tax records are full earlier than submitting helps taxpayers avoid errors that result in processing delays. When they've all their documentation, taxpayers are in the most effective position to file an correct return and avoid processing or refund delays or IRS letters. All revenue, including from part-time work, aspect jobs or the sale of products is still taxable.

Get Copies And Transcripts Of Your Tax Returns

Tool as quickly as a day, usually in a single day, so taxpayers don't want to verify the standing more typically. You could not have filed a tax return because your wages had been beneath the submitting requirement. But you presumably can nonetheless file a return within three years of the filing deadline to get your refund. Every year, the Internal Revenue Service has hundreds of thousands of dollars in tax refunds that go undelivered or unclaimed. Also, if you’re nonetheless lacking your third stimulus payment, you may obtain that if you get your tax refund.

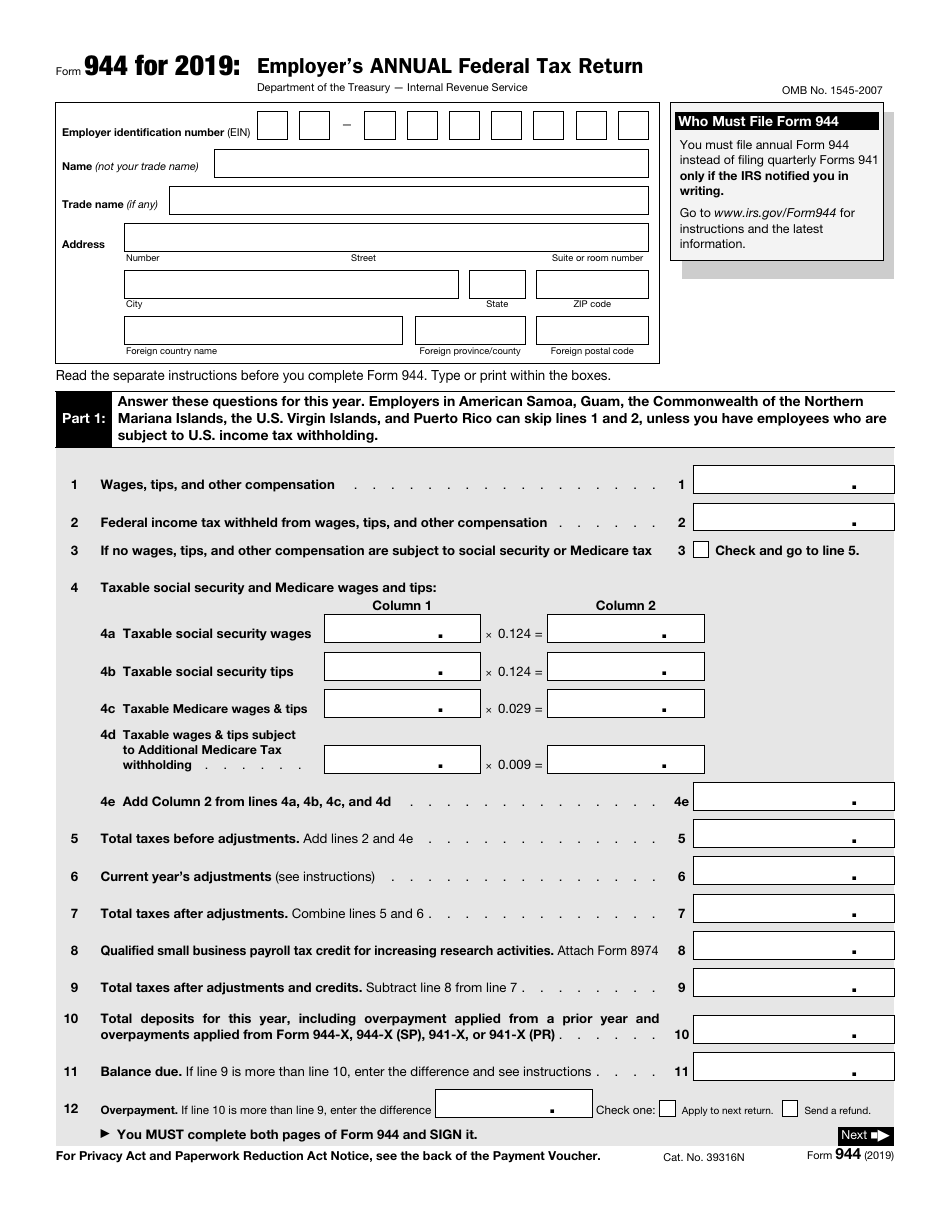

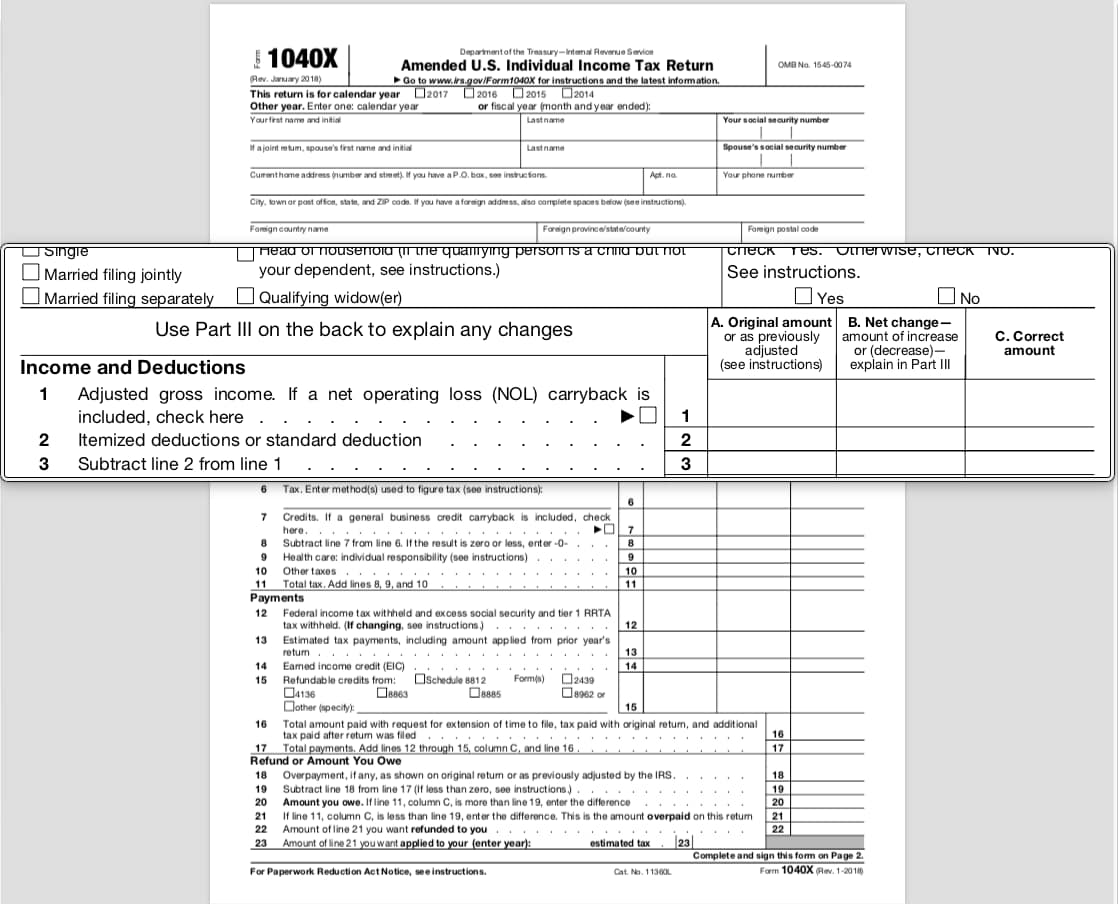

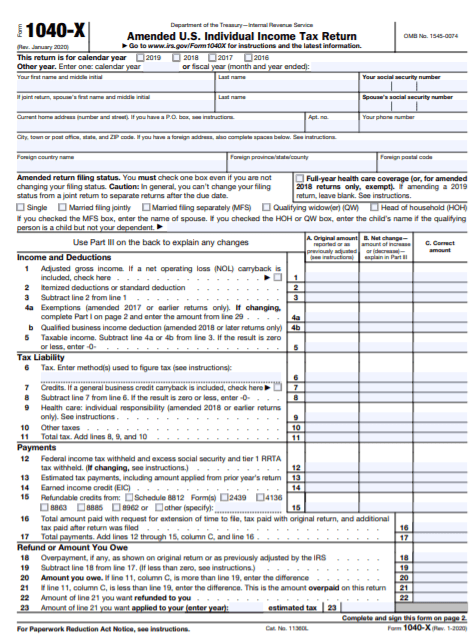

Get the current submitting year’s forms, instructions, and publications free of charge from the Internal Revenue Service . Our telephone and walk-in representatives can solely analysis the standing of your amended return sixteen weeks or more after you’ve mailed it. Refund information for Form 1040X, Amended U.S. Individual Income Tax Return is not out there on Where’s My Refund. Schedule an appointment for you at one of our native Taxpayer Assistance Centers so you can get assist face-to-face.

Turbotax Online Guarantees

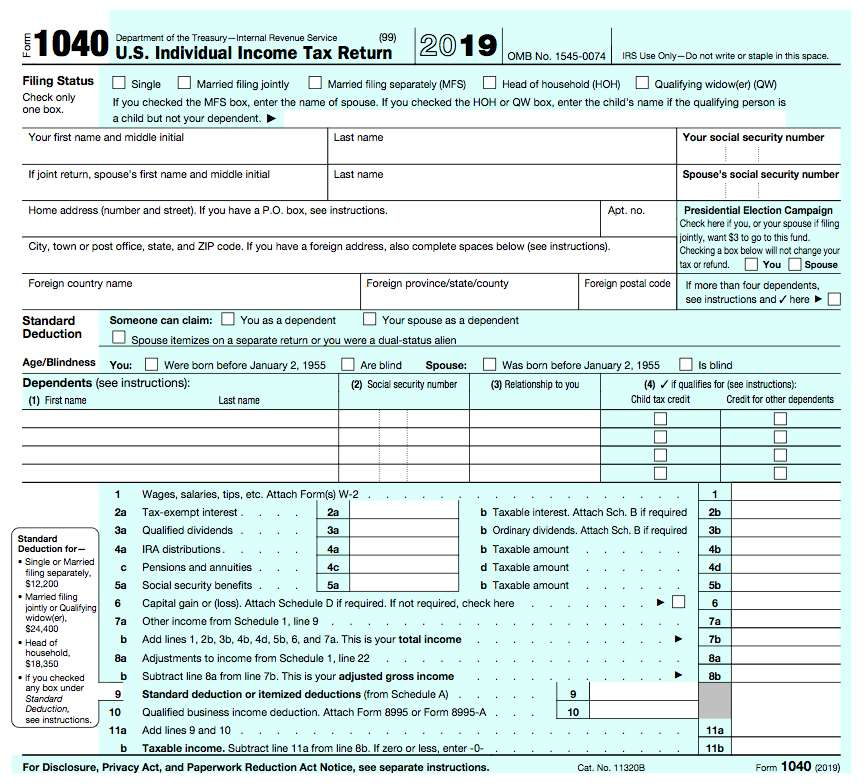

Welcome to IRS Free File, the place you can electronically put together and file your federal particular person income tax return free of charge using tax preparation and filing software program. If you were expecting a federal tax refund and didn't obtain it, check the IRS' Where’s My Refund page. You'll must enter your Social Security quantity, submitting status, and the precise whole dollar amount of your refund. There are several issues that could possibly be tacked on to your tax refund this year. As traditional, if you overpaid your taxes in 2021, you’ll obtain that money again.

Make the check or cash order payable to the United States Treasury. If you file your taxes by paper, you’ll need copies of some varieties, instructions, and worksheets. Taxpayers may need to contemplate estimated or further tax payments because of non-wage income from unemployment, self-employment, annuity income and even digital property.

And, our tax execs can highlight every tax alternative for you – from tax credit to deductions – to maximize your federal refund. There might be some main modifications to tax deductions and credits for tax year as many expanded benefits of the American Rescue Plan go away. TurboTaxis reminding filers to know which credit will be reverted or retired for filing, together with adjustments to theChild Tax Creditand Earned Income Tax Credit. A portion of the price of union membership can be offset by a tax credit known as the Workers Tax Fairness Credit. If California enacts future legislation, union members shall be entitled to a tax credit on account of a change in the state’s tax deduction.

If you worked final year but earned a low or average earnings, you may qualify for the Earned Income Tax Credit . With this tax credit, you can nonetheless earn a refund even should you don't owe any tax. Generally, the IRS will first mail you a bill should you owe taxes. You also should generally pay self-employment tax. This is a social safety and Medicare tax primarily for people who work for themselves. Your self-employment tax payments contribute to your protection under the Social Security system.

File A Federal Earnings Tax Return

Furthermore, because the utmost quantity of charitable donations that can be deducted has been lowered, individuals will be succesful of claim the deduction for charitable donations extra easily. Deductions for objects important to the taxpayer might be less likely to be claimed by those affected by the elimination of miscellaneous itemized deductions. People who have relied on the deduction for state and native taxes, for instance, could now be pressured to search out other ways to reduce their taxes.

To see if your state tax return was obtained, you can examine with your state’s income or taxation website. There, yow will discover out if your refund is being processed. Or, you could get additional contact info to verify that your return was obtained.

If you’ve paid an extreme quantity of, you’ll get a tax refund. The most handy approach to verify on a tax refund is by utilizing the Where's My Refund? Taxpayers can start checking their refund status within 24 hours after an e-filed return is obtained. Although the dollar for greenback deduction for union dues isn't a deduction in your general union dues, if you itemize your state revenue tax returns, you will be able to deduct them. Contact your personal tax consultant to verify your personal tax scenario.

Make certain that you just copy your varieties before sending them off and double-check the handle. If the forms go to the mistaken tackle then your refund could additionally be delayed. If you may be on low revenue, there might be smaller fees for applying for these payment extensions. If you may be submitting but not making your tax cost then there might be a different address that you will want to use. If you're planning to mail back your return without paying then you will need to publish to a different tackle than when you were sending a fee.

SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the us Securities and Exchange Commission as an funding adviser. SmartAsset does not evaluate the ongoing performance of any RIA/IAR, participate in the administration of any user’s account by an RIA/IAR or provide recommendation regarding particular investments. Remember that a tax deduction reduces your taxable revenue, cutting your tax bill indirectly by lowering the earnings that is subject to a marginal tax price. A tax credit is a dollar-for-dollar low cost in your tax bill. So, should you owe $1,000 but qualify for a $500 tax credit score, your tax invoice goes down to $500.

No comments:

Post a Comment