Table of Content

Where the shape must go will depend upon exactly what return you are attempting to file. Each type of form and tax return has its personal mailing address and when you should send it's going to depend on the place within the nation you live. When you are submitting your tax returns, you will really feel like each single part of the process is difficult.

If your tax refund goes into your checking account by way of direct deposit, it could take an additional five days in your bank to put the money in your account. This means if it takes the IRS the complete 21 days to issue your verify and your financial institution 5 days to deposit it, you could be waiting a total of 26 days to get your tax refund. Online companies like Venmo and Cash App can deliver your tax refund a couple of days sooner since there’s no waiting interval for the direct deposit. The IRS usually issues tax refunds inside three weeks, but some taxpayers might have to attend some time longer to obtain their funds. If there are any errors in your tax return, the wait could be prolonged.

The Place Is My Federal Earnings Tax Refund

Get Your Tax Forms Make certain you could have the forms you have to file your taxes, including Form W-2 out of your employer and your previous tax transcripts. All features, services, help, costs, offers, phrases and circumstances are topic to vary with out discover. Yes, you'll be able to deduct union dues in your 2021 taxes. The quantity you presumably can deduct depends on your tax bracket and whether or not you itemize deductions.

The date you obtain your tax refund also is dependent upon the tactic you used to file your return. You should use that years type along with your individual data of payments made to determine your eligibility for a tax credit. - You can begin checking on the status of your return sooner - within 36 hours after you file your e-filed return or four weeks after a mailed paper return. Well, you must all the time try to file your tax return on time to keep away from paying any extra fines.

File A Federal Revenue Tax Return

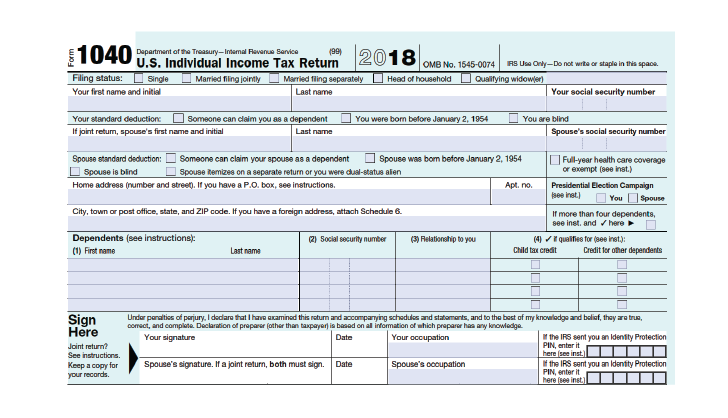

Free File associate firms might not disclose or use tax return information for functions apart from tax return preparation with out your knowledgeable and voluntary consent. These companies are additionally subject to the Federal Trade Commission Privacy and Safeguards Rules and IRS e-file regulations. When self-preparing your taxes and submitting electronically, you should signal and validate your electronic tax return . To verify your identity, use final year’s AGI or last year’s self-select signature personal identification number . To signal your electronic tax return, use a 5 digit self-select PIN, any 5 numbers that you simply select which serves as your electronic signature.

Paychecks, employer-paid fringe benefits, and payroll taxes are all included on this class. A union dues deduction is an employee benefit, not an employer contribution. Payroll, unemployment, authorities advantages and other direct deposit funds can be found on effective date of settlement with provider.

Is Your Tax Refund Decrease Than You Expected?

Our professionals have an average of 10 years’ expertise dealing with even the most unique tax situations. File with a tax pro At an workplace, at residence, or each, we’ll do the work. While not technically new, for 2022 the IRS is making a extra concerted effort to trace cryptocurrency gross sales and trades. Whenever you promote or commerce your crypto or buy an merchandise with crypto, you trigger a taxable event.

Your Online Account Make funds towards your steadiness and handle profile preferences for account exercise. Determine if you are taking the usual deduction or itemizing your return. Filing status relies on whether you are married. The proportion you pay toward family expenses additionally impacts your submitting standing.

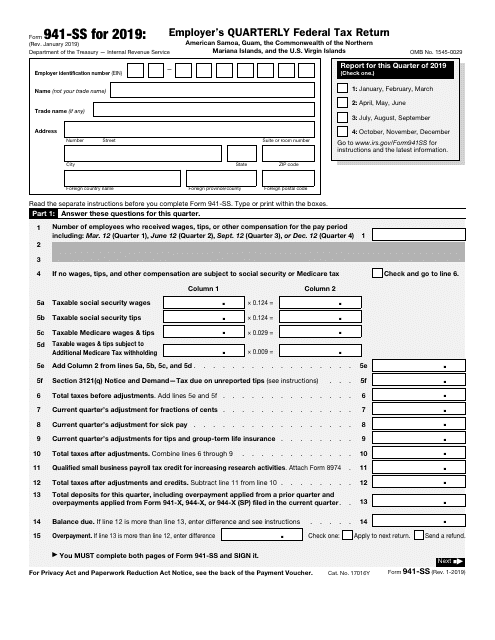

The IRS does settle for e-filed 941 Forms for Employer's Quarterly Federal Tax Returns and so they encourage employers to e-file somewhat than mail. Otherwise, use the addresses under to mail your 941 Return based mostly on the state the enterprise operates and whether or not you owe taxes. Once youve gathered your documents, take a while to review them totally, says tax professional Lisa Niser. This will help determine how a lot you owe the IRS or how much you'll be able to expect to obtain in a refund.

The most penalty is 50 % of the tax due or $500, the latter of which you’ll should pay even if you’re entitled to a refund. According to H& R Block, there is not any federal penalty when you don’t owe any tax. However, you won’t obtain a refund till after you file your return.

Employers should send you your W-2 by January 31 for the earnings from the previous calendar yr of work. This kind exhibits the revenue you earned for the 12 months and the taxes withheld from those earnings. By mail - To get a transcript delivered by postal mail, submit your request on-line. The IRS will ship your transcript within 10 days of receiving your request. You may have a replica or a transcript of a prior yr's tax return.

The construction of your business determines what enterprise taxes you must pay and how you pay them. Nonresident aliens are taxed solely on their revenue from sources throughout the United States and on sure earnings connected with the conduct of a commerce or enterprise in the United States. If you're a U.S. citizen or resident alien, your worldwide earnings is topic to U.S. earnings tax, regardless of where you reside. Your tax obligations as an international particular person taxpayer depend upon whether or not you're a U.S. citizen, a resident alien, or a non-resident alien.

No comments:

Post a Comment